With their long and winding coastlines, the oceans have always provided an abundance of economic resources to the Nordic region: from fisheries as a key food source; as a stage for trade and exploration; and – in more recent history – as a source of energy from beneath the seabed and of renewable energy on the surface.

The oceans are intertwined with the history and the economies of the Nordic region. And for this reason, the Nordic region has become a world-leading cluster for business, finance, and technology for ocean industries globally.

Figure 1: Nordic Region With Leading Position in the Ocean Industries

Source: Storm Private Capital analysis

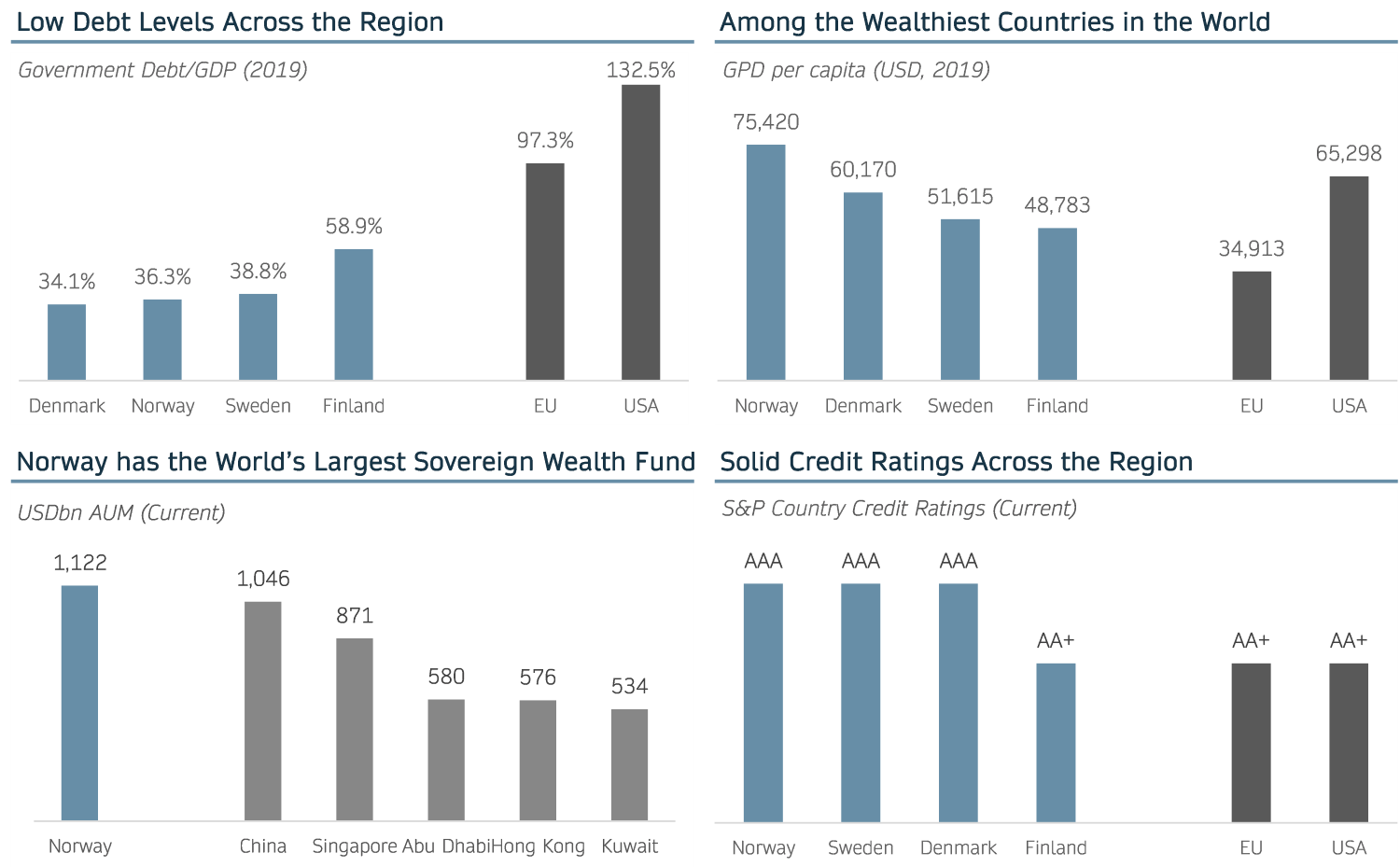

The Nordic economies are strong, transparent, and stable. The region has GDP per capita in the global top tier, healthy government finances, and AAA credit ratings. The region also hosts one of the largest sovereign wealth funds globally. Furthermore, the region ranks high in human development and government trust providing a stable and predictable business environment for companies domiciled in the region. With its robust, transparent, and well-regulated economies, shared similar languages, and high corporate governance standards, the Nordic region offers a geographical basis for low investment risk.

Figure 2: The Nordic Economies: Strong, Transparent, and Stable

Source: OECD, UN, World Economic Forum

As the ocean industries are taking on the transition towards a carbon neutral future, the Nordic region is well positioned. Sustainability has always been a core value in the Nordic region. Measures were taken in the 1970s to successfully restore fish stocks form overfishing and renewable energy already represents near 100% of Norway’s electricity production, providing for export potential to other countries. The four Nordic nations are also ranked top four in asset manager RobecoSAM’s sustainability ranking.

As a world-leading ocean industries technology cluster, the Nordic region also has a competitive advantage in leading the energy transition. This is already seen across broad spectrum of initiatives, supported by public and private interests: from the development of new low or zero carbon fuels, vessel designs, and propulsions technologies; to innovative and sustainable salmon farming processes; and the development of new value chains related to the capture and storage of CO2.

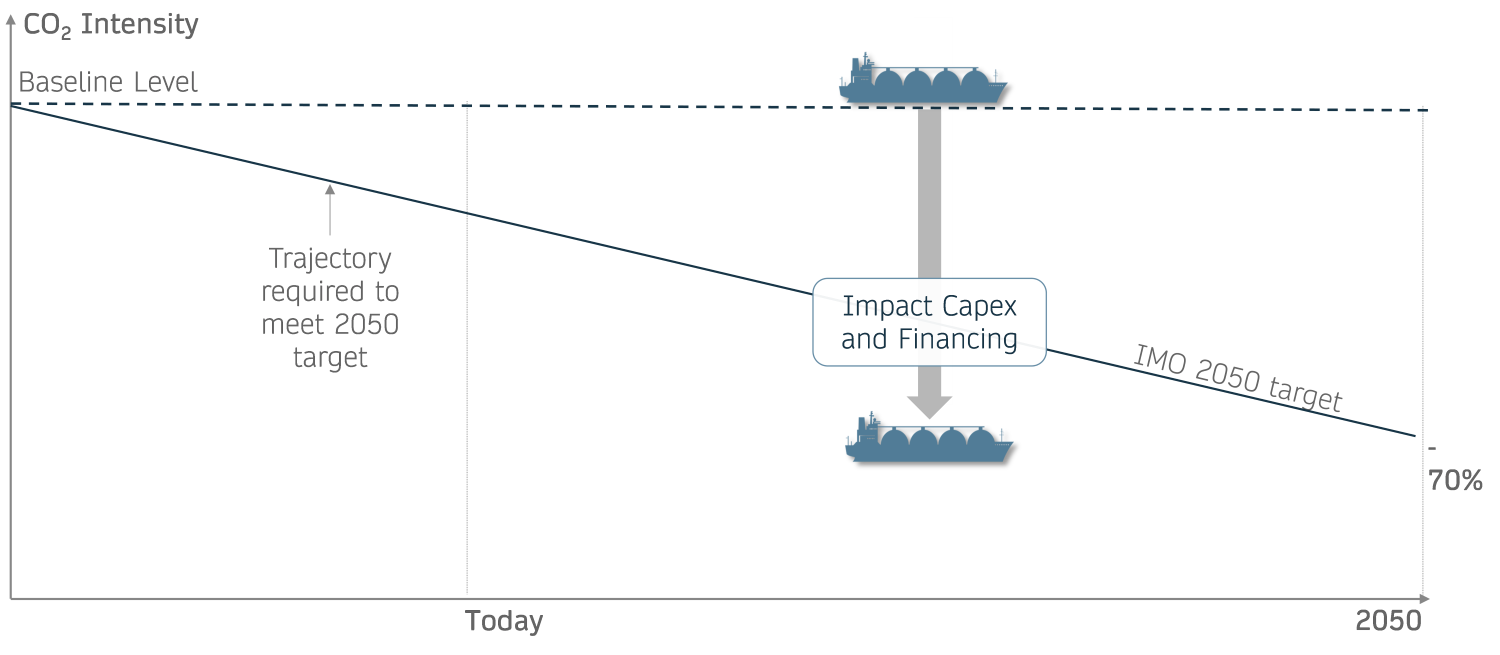

Figure 3: Energy Transition Driving Growth in Financing Demand

Source: International Maritime Organization (IMO), DNV, Storm Private Capital analysis

The ocean industries’ energy transition is gaining momentum due to new regulation and consumer demand. This capital-intensive transformation will drive substantial financing demand from both traditional sources and alternatives such as private credit.

Private credit as an asset class has grown substantially over the last ten years. This growth was initially led by the U.S., where private markets are more developed and the banking system was earlier to adapt to more restrictive regulations but has over the recent years also started to catch up in Europe, in response to more restrictive banking regulation. Compared to capital markets instruments, private credit seeks to derive incremental returns from illiquidity premium the same way private equity seeks to derive an illiquidity premium over public equity.

A number of different private credit strategies have emerged over the recent years. Some focus on small and medium sized enterprises (SMEs) in specific regions, while others have focused on sponsored-backed direct lending, financing private equity led buyouts. Private credit strategies within infrastructure have also emerged, often with longer tenors to reflect the long dated economic life of the assets they are financing. But private credit has typically not differentiated on sectors with most strategies having a generalist sector focus.

Private equity has seen sector specialisation for some time, within segments such as consumer, financial services, energy, healthcare, or technology. Sector focused strategies are based on the notion that by being closer to the industry, managers should be better able to identify opportunities and avoid common industry pitfalls. Additionally, by taking advantage of long-standing relationships in their sectors, managers should also be able generate more attractive and differentiated investment deal flow compared to a generalist strategy, as some of these opportunities may not be available to the general market.

It is with this background that Storm Capital Management AS is expanding into private credit. Storm is an independent asset manager based in Oslo and has managed the Storm Bond Fund (UCITS) since 2008. The Storm Bond Fund, at USD 260 million AUM, specialises in the corporate bond market in the Nordic region.

Last year, a team of three experienced private credit managers joined Storm and set up Storm Private Capital. The team previously ran a private credit strategy focused on the ocean industries, managing a USD 381m fund for Offshore Merchant Partners, a portfolio company of leading Norwegian PE firm HitecVision. The Storm Private Capital team has over the last 18 months structured and arranged more than USD 1 billion of senior and subordinated financing transactions in the ocean industries, financing infrastructure assets backed by long term contracts.

The Storm Private Capital team is now launching their second private credit fund, focusing on infrastructure private credit in the ocean industries. The fund will predominantly source its investments in the Nordic region, targeting unitranche and subordinated credit investments with high cash yield, contractual returns, and emphasis on capital preservation.

The Storm Private Capital team believes that the timing is excellent. While the structural and regulatory factors driving demand for alternative capital have been present for some time, the ocean industries’ energy transition is set to accelerate financing demand. Operators across the maritime logistics, aquaculture, and offshore renewables segments will need to invest significant capex to adapt to and support a low carbon future and this will require financing from traditional as well as alternative sources. Storm’s private credit initiative will provide institutional capital access to such infrastructure investments in the ocean industries, complementing traditional core and core+ infrastructure portfolios, while contributing to the ocean industries’ energy transition towards carbon neutrality.

---

*) Thomas W. Pedersen, CIO and Founding Partner at Storm Private Capital

Veranstaltungshinweis: Thomas W. Pederson von Storm Private Capital spricht auch im Rahmen unserer IPE DACH Frühstücksseminare Private Debt im Fokus über das Thema „Financing Nordic Ocean Infrastructure“. Mehr dazu finden Sie über folgenden Link.

Guest view: Infrastructure Credit in the Nordic Ocean Industries

Thomas W. Pedersen