In our engagement with clients and investors, we detect a geographical gulf in the overall familiarity with the South Korean commercial property market. A particular group of investors might extrapolate existing circumstances in Europe and the US, which consequently nudge them towards an overly sombre view of prospects in Asia, including the South Korean market. On the other hand, domestic and experienced inbound investors adopt a nuanced and balanced view of the current landscape, and continue to see selective opportunities in the South Korean property sector.

We think it is useful to lay out the broad framework with which we view the structural prospects of the South Korea market.

THE VIEW FROM TOP-DOWN

South Korea’s real estate market is fundamentally intertwined with the prevailing economic conditions. We see a few structural macro drivers.

Deep rooted economic dynamism

The saying "Miracle on the Han River" refers to the extraordinary economic metamorphosis witnessed by South Korea in the decades following the Korean War in the 1950s. South Korea’s nominal GDP more than doubled from approximately USD 700 billion in 2003 to USD 1.7 trillion in 2022. We expect the Korean economy to grow by more than 70% between now and 2030, reaching a heft of almost USD 2.9 trillion by the end of this decade. According to IMF estimates, in nominal terms, South Korea ranks as the 12th largest economy in the world, and the 4th largest in Asia, just behind China, Japan and India.

Fiscal and monetary strength

South Korea's credit rating compares favourably, if not better, than many countries. It underscores the country's strong economic fundamentals and prudent fiscal management. As of April 2023, South Korea’s credit rating stands at AA, which is now two levels higher than Japan’s A+ rating. Referencing core investors’ penchant for Japan real estate, South Korea easily presents itself as another capital destination in Asia, without having to underwrite significant country risk premiums.

Global leader in technological innovation

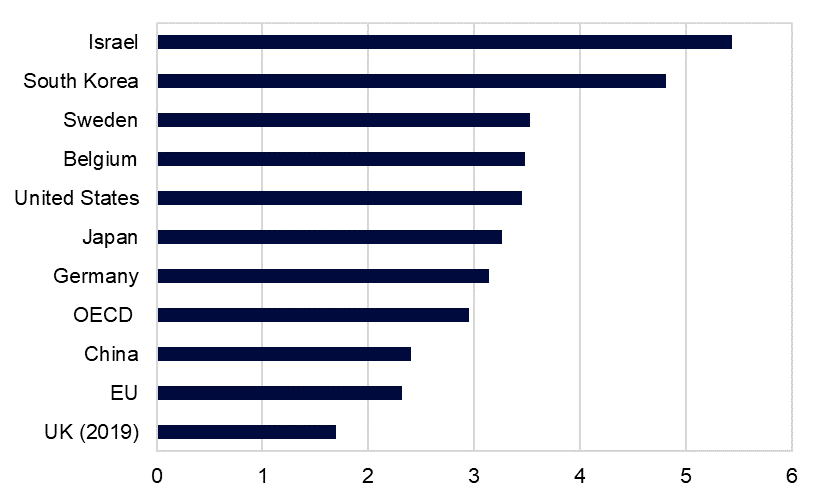

The World Bank's data indicates that in 2020, the country dedicated 4.8% of its GDP to R&D, significantly outpacing the approximate 3.0% average in the OECD. This investment in research has spawned numerous technological giants which have been instrumental in shaping South Korea's status as an economic powerhouse. High R&D has also helped to negate a demographic tax through the unyielding drive for technological productivity.

Figure 1: R&D spend as % of GDP

Source: World Bank, World Development Indicators, as at 14 July 2023

Strong industrial base and diversified service sector

South Korea maintains a diversified export-oriented economy, focused on the higher end of the manufacturing value-chain. Also, South Korea's service sector has been evolving and diversifying, contributing over 58.2% to the country's GDP as per World Bank data as at 2022. The growth of the services sector has multiple implications for the property market, such as steering end-user demand for commercial real estate, supporting urbanisation, and facilitating the creation of new growth precincts.

SOUTH KOREA COMMERCIAL REAL ESTATE

The heart and Seoul of South Korea

Seoul exerts substantial dominance over South Korea's economic, cultural, and political dynamics. It is also the key real estate investment market. According to MSCI data, South Korea constitutes around 3.8% of the investable real estate universe in Asia Pacific. On a city-level perspective, Seoul edged out traditional heavyweights - such as Shanghai, Sydney and Melbourne – and saw the second highest level of transactional activity in Asia Pacific in 2022. That was certainly not a flash in the pan, because we saw very similar, if not stronger, outcomes in 2020 and 2021. As at H1 2023, Seoul has retained its position amongst the top three most active markets in APAC, based on preliminary data from MSCI RCA.

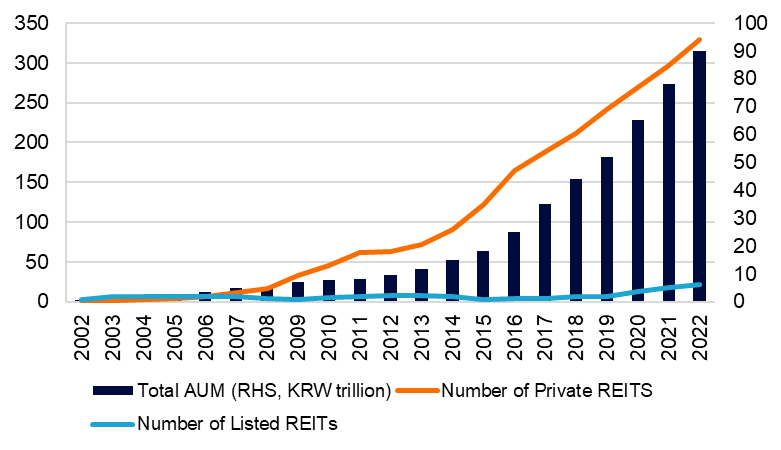

Ongoing institutionalisation of real estate market

The experiences of other real estate markets such as Japan and Singapore have proven that an established REIT market plays a critical role in the institutionalisation of the commercial real estate sector. As at end-2022, a total of 350 REITs were active in South Korea, with 21 being listed REITs. Notably, the AUM of the REIT sector has exploded by 160 times in the last two decades, from KRW 0.5 trillion in 2002 to KRW 89.9 trillion in 2022. The growing REIT sector presents an additional avenue for international capital to participate in the Korean real estate market. A diversified capital pool provides additional liquidity and also contributes to market stability and resilience. With better disclosure requirements, there will be a more efficient price discovery mechanism, which improves the overall transparency in the property sector. Considering the significant percentage of real estate sitting on corporate balance sheets in Korea, a thriving REIT market could incentivise major Korean corporations to sponsor REIT listings and recycle their capital. This transition would transform traditionally owner-occupied and high-quality assets into investable stock.

Figure 2: Evolution of REIT market in South Korea

Source: Korea Association of Real Estate Investment Trusts, Spring 2023 Journal

STRATEGIC VIEWS

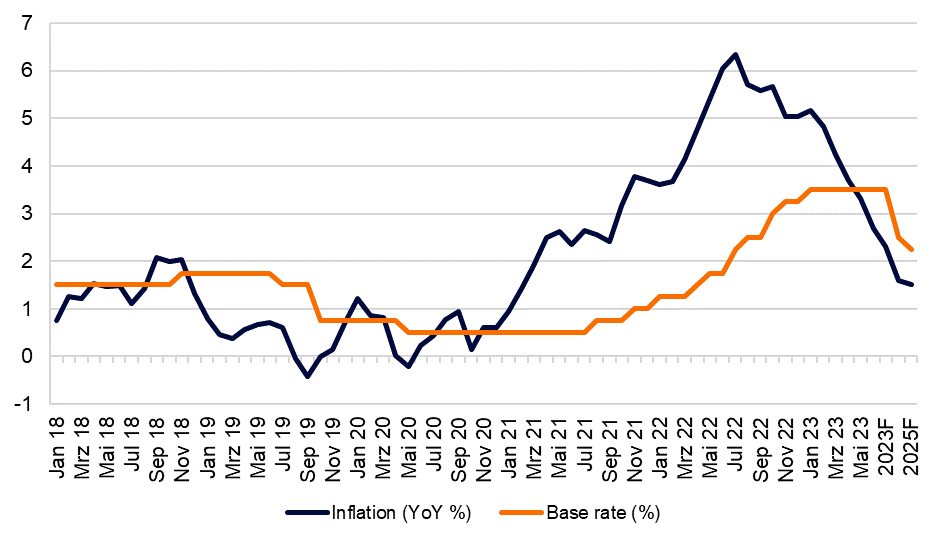

We are living in unique times

South Korea was one of the earliest countries globally to kickstart the interest rate hike cycle. Base rates have moved up ten times in South Korea, by a total of 300 bps. That has given rise to concerns that a major repricing in the Seoul property market is looming. Oxford Economics forecasts that annual inflation will trend down to around 1.6% by the end of 2024. Consequently, we could expect the Bank of Korea to take its foot off the accelerator slightly.

Figure 3: Inflation and policy interest rate (%)

Source: Macrobond (15 July 2023), Oxford Economics (15 July 2023)

In the office sector, despite interest rates having increased by around 300bps, we expect that cap rates will shift out by only 40 bps to 60 bps by the end of 2023. Occupier performance has been robust in the Seoul office sector, which has helped to fend off pressures on pricing. A high return-to-office rate is supporting end-user demand office space. According to Savills Research, the office vacancy rate in Seoul was 1.8% in Q2 2023, and aggregate rents growth was 7.1% y/y in the same period. These numbers put the Seoul office sector as one of the best performing markets globally.

It is not hard to appreciate the structural appeal of the South Korea real estate market, both from the economic and institutionalization angles discussed previously. However, the ability to source for the right deals is a key differentiator of tactical performance. Strong and quality assets continue to defy the gravity of interest rates, while average assets struggle to find buyers. Admittedly, that is hardly a revelation, but we are seeing it play out in the South Korean market right now. If investors take a wait and see approach, there is a chance that entry yields might end up sharper when interest rates start to normalise, which is the same time when competition for limited assets will intensify. To that end, we are of the view that core and core-plus investors who have reasonable return targets will still find the Seoul office market appealing today, and in the longer term.

THE ESG RECKONING

We think we are at an inflexion point which will herald a widespread adoption of ESG-compliant assets in the Seoul commercial real estate market. The Seoul Metropolitan Government is concentrating efforts on enhancing the energy efficiency of existing older structures, while also promoting the construction of new buildings to align with Zero Energy Buildings (ZEB) standards. Over time, Seoul would certainly become an appealing market for core investors with a focus on sustainability.

Research have shown that there is a rental premium for offices with green certification, albeit to varying degrees. In Seoul, green-labelled buildings can command some 10% rental premium over similar assets without green certifications, which is not insignificant. At Savills Investment Management, we are proponents of refurbishment and do not favour redevelopment, given the extensive embedded carbon footprint in the latter. Investors with a higher risk appetite can capture the rent reversion story by partaking in the upgrading of ageing assets in Seoul, particularly in submarkets where vacancies are tight.

---

*) Shaowei Toh, Head of Research & Strategy Asia Pacific, Savills Investment Management