United Bankers

Adresse:

Aleksanterinkatu 21 A

00100 Helsinki, Finland

Telefon:

+358 9 2538 0320

Webseite:

Teamgröße:

5 Mitarbeiter (institutioneller Bereich, davon 3 Mitarbeiter Finnland/Schweden, 2 Mitarbeiter DACH-Region)

00100 Helsinki, Finland

Ansprechpartner für das institutionelle Geschäft

Jauri HäkkäBusiness Development, European Markets

+46 73 741 8008

jauri.hakka@unitedbankers.com

Nils Schalin

CEO, UB Asset Management, Sweden

+46 8 1245 6020

nils.schalin@unitedbankers.com

Heli Heikkilä

Director, Institutional Clients

+358 9 2538 0334

heli.heikkila@unitedbankers.fi

Unternehmensüberblick/Kurzbeschreibung

United Bankers – Your Nordic Experts in Real Assets.

United Bankers Plc is a Helsinki-based Financial Services group. Founded in 1986, United Bankers (UB) started its business in securities brokerage. Today, the company's business areas include Asset and Wealth Management and Capital Markets services. UB Fund Management Ltd, established in 2007, is a subsidiary of the group dedicated to the administration of investment funds. These funds include European Union UCITS regulated vehicles and AIFMD regulated funds.

UB Fund Management has a particular focus on funds based on Real Assets investment strategies. In Asset Management, the company has specialised in globally diversified investment solutions, where Real Asset strategies have a significant role.

Asset and Wealth Management

UB's Asset Management business includes investment funds, discretionary asset management and structured investments. In addition to traditional equity and fixed income funds, UB offers a range of Real Asset funds and investment strategies. These include funds investing in listed real estate securities, funds investing in direct real estate, infrastructure funds and forestry funds. United Bankers is a Nordic pioneer and a global specialist within Real Asset investments. Within Wealth Management, UB offers discretionary Asset Management services to private and institutional asset owners in Finland and Sweden.

Im deutschsprachigen Markt aktiv seit: 2020

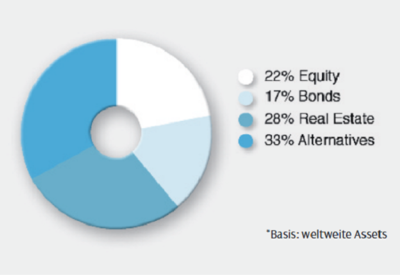

Assets under Management nach Assetklassen*

Assets under Management in Zahlen (in Mio. Euro)

Angebotene Investmentvehikel

Services

Performancemessung/-Verifzierung

Angebotene Assetklassen

Equity

| Global | Europe | Germany | US | Japan | Asia/Pacific | Emerging Markets | Andere: CEE | |

| Aktiv/Passiv (auch ETFs) | X/ | X/ | / | X/ | / | X/ | X/ | X/ |

| Quantitativ/Qualitativ | X/X | X/X | / | X/X | / | X/X | X/X | X/X |

| Small Cap/Large Cap | / | / | / | / | / | / | / | / |

| Growth/Value | / | / | / | / | / | / | / | / |

| Absolute/Relative Return | / | / | / | / | / | / | / | / |

| Factor Investing | ||||||||

| ESG-Ansatz/Impact Investing | / | / | / | / | / | / | / | / |

| Andere: Forestry | X |

Real Estate

| Core/Core+ | Value-added | Opportunistic | Andere: | |

| Spezialfonds | X | |||

| Publikumsfonds (offen) | X | |||

| Sektorenfonds | ||||

| REIT-Fonds | X | |||

| Fund-of-Funds | ||||

| Closed-end-Funds | X |

Erläuterung

Remarks to Sectors: Nordic Commercial Property, Forestry, Global REITs, InfrastructureReal Assets

| Infrastructure | Private Equity | Renewables | Commodities | Andere: | |

| Infrastructure / Real Assets, UCITS | X |

Erläuterung zu den angegebenen Produkten bzw. Strategien

Real Assets represent an investment opportunity with attractive and stable returns. United Bankers have built up a capability in managing investment strategies in this area over a time span covering several decades.

The UB Real Asset investment team has navigated the markets during times of distress and uncertainty as well as periods of exceptional growth. During this time, they have accumulated a wealth of experience, skills, and data – covering a broad spectrum of geographies, sectors, and individual companies around the world.

Examples of investment strategies that the UB Real Asset team cover globally within the asset class include listed Real Estate and Infrastructure. In addition, the team has a particular expertise within Nordic Real Estate as well as Nordic and Baltic Forestry.

Erläuterungen zu Research/Investmentprozess

United Bankers manage investment strategies in a variety of asset classes, most of which can be defined as Real Assets. The investment process for each strategy follows a distinct philosophy, taking into account the characteristics of the markets where they invest. The strengths of each strategy rely on meticulous research. A rigorous quantitative analysis is a key part. This typically embodies both a topdown and a bottom-up approach.

Our Infrastructure strategies focus on companies that have an economic moat, i.e. ‘monopolistic’ market positions with limited competition. Together with other exogenous factors, such as macroeconomics and sector sustainability, this complements the stock-specific analysis that reflects both the actual and expected earnings and profitability of each company. In a similar fashion, our REIT and Real Estate strategies have active regional and sector weights. However, they also focus on each holding from both a quantitative and a qualitative point of view.

Welche Rolle spielen ESG-Ansätze und -Faktoren in den Investmentansätzen?

Integrating the responsibility aspect into UB’s products and services is a key part of the group’s overall risk management. When choosing an investment target, responsibility is taken into account prior to the investment decision. Responsibility outcomes are monitored and regularly reported to investors.

We have excluded companies that contribute to the production and sale of controversial weapons (land mines, cluster bombs, depleted uranium, biological and chemical weapons), or are involved in the development and production of nuclear weapons programs. We do not invest in companies, whose main activities are the production of tobacco, weapons or coal, adult entertainment or gambling.

Our aim is to reduce the negative climate impact of our investments and to increase the positive sustainability impact of our investments in the long term. To monitor these goals, we publish an annual responsibility report on our investment activity. In addition, we integrate a responsibility overview in the regular monthly and quarterly overviews of our funds.

For all our funds, we report on their carbon intensity measure and the corresponding level of the selected benchmark index on a monthly basis. In addition, we endeavour to report on all our funds regarding the positive sustainability impact, according to the UN-defined Sustainable Development Goals.

Worauf liegt Ihr Fokus im Jahr 2024?

We will focus increasingly on sustainability, ensuring that factors related to environmental, social and governance elements are considered. We will increase our efforts to integrate specific sustainable development goals into our investment processes. This will also help us avoid so-called stranded assets in certain sectors.

We will follow closely the effects of Covid-19 in each of the regions, countries and sectors where we invest. Forecasting actual outcomes will be challenging, but we do believe that understanding the stages of the economic recovery will help us avoid excessive risks.