Baillie Gifford Investment Management (Europe) Limited Frankfurt

Adresse:

WINX Tower, Neue Mainzer Str. 6-10

60311 Frankfurt am Main

Telefon:

+49 (0)69/5899 63714

Webseite:

Teamgröße:

3 dedicated client service professional supported by a team of 14

60311 Frankfurt am Main

Ansprechpartner für das institutionelle Geschäft

David GaschikHead of Germany and Austria

+49 (0)69/5899 63711

david.gaschik@bailliegifford.com

Sebastian Jeuk

Senior Manager Business Development

+49 (0)69/5899 63714

sebastian.jeuk@bailliegifford.com

Unternehmensüberblick/Kurzbeschreibung

Baillie Gifford & Co was founded in Edinburgh in 1908 and is one of the UK’s largest independent investment management firms, 100% owned by the 51 partners, all of whom work within the firm. Our partnership structure has not changed since 1908 and we are committed to retaining this structure.

Throughout the early part of the twentieth century, Baillie Gifford & Co developed and managed a wide range of investment trusts investing in equities and bonds worldwide.

During the 1960s, Baillie Gifford developed its International Equity discipline, becoming one of the first European investment firms to explore the markets of Japan and the other areas in the Far East. In recent decades the firm has forged successful investment specialties in Japan, Europe, North America, Emerging Markets and global equities.

More recently, as our record of stable organic growth has continued, the firm has steadily diversified both in terms of client base and by the range of investment strategies we offer such as multi asset and fixed income strategies. Investment management is our only business.

Im deutschsprachigen Markt aktiv seit: 1999

Mitgliedschaften in Verbänden

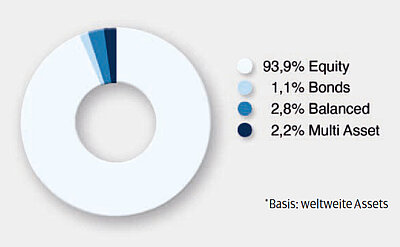

Assets under Management nach Assetklassen*

Assets under Management in Zahlen (in Mio. Euro)

Angebotene Investmentvehikel

Services

Performancemessung/-Verifzierung

Angebotene Assetklassen

Equity

| Global | Europe | Germany | US | Japan | Asia/Pacific | Emerging Markets | Andere: | |

| Aktiv/Passiv (auch ETFs) | X/ | X/ | / | X/ | X/ | X/ | X/ | X/ |

| Quantitativ/Qualitativ | /X | /X | / | /X | /X | /X | /X | /X |

| Small Cap/Large Cap | X/X | X/X | / | X/X | X/X | /X | X/X | X/X |

| Growth/Value | X/ | X/ | / | X/ | X/ | / | X/ | X/ |

| Absolute/Relative Return | X/X | X/X | / | X/X | X/X | X/X | X/X | X/X |

| Factor Investing | ||||||||

| ESG-Ansatz/Impact Investing | X/X | / | / | / | / | / | / | / |

Bonds

| Global | Europe | Germany | US | Japan | Asia/Pacific | Emerging Markets | Andere: | |

| Staatsanleihen | X | |||||||

| Corporate Bonds | X | X | ||||||

| High Yield | X | X | ||||||

| Convertible Bonds | ||||||||

| Absolute Return Strategien | ||||||||

| Inflation Linked Strategien | X | |||||||

| Geldmarktstrategien | ||||||||

| ESG-Ansatz bzw. Impact Investing | ||||||||

| Andere: Andere | X |

Alternative Investmentlösungen

We offer a Multi Asset strategy which is an actively managed portfolio investing across a broad range of different asset classes, markets and investment instruments. The strategy provides a diversified portfolio and the aim is to achieve attractive long-term returns but at lower risk than equity markets. The strategy has a dual objective:

- TTargeting an attractive level of return: 3.5% p.a. over UK Base Rate, net of fees, annualised over rolling five-year periods.*

- With lower volatility than equity markets: annualized volatility of less than 10% over rolling five year periods.

*The objective stated is not guaranteed

Erläuterung zu den angegebenen Produkten bzw. Strategien

The firm offers a relatively small number of variations on equity, fixed income and multi-asset investing and, subject to capacity, promotes each equally over time according to client demands and suitability. The majority of our new business in recent years has been in our global and international equity strategies, although we have also seen growth in regional equity and multi-asset mandates.

We believe that ultimately share prices follow fundamentals and that sustainable earnings growth leads to long-term outperformance. We add value by making investments in well-managed, growth businesses that enjoy sustainable competitive advantages in their market place.

Proprietary research and fundamental analysis are central to identifying investment opportunities; all of our Investment Managers have analyst responsibilities.

Our team structure is central to our culture. Whilst we have a clear assignment of responsibilities and ownership with regard to portfolio construction, we actively encourage debate and idea generation within and across all our investment teams. This supports and encourages a global perspective.

Erläuterungen zu Research/Investmentprozess

We are long-term investors, not speculators. Our investment philosophy focuses on growth, while our universe of potential opportunities is global. Accordingly, we believe that fundamental analysis and proprietary research are core to a successful, long-term, bottom-up investment approach.

We are able to harness this intellectual curiosity with a rigorous approach where the sharing of ideas and robust debate among our investment teams are central to our philosophy and process.

In equities, our belief is that sustained growth in company profits leads to higher share prices over time. In bonds, we take a differentiated investment approach which focuses on long-term prospects rather than the potential for short-term price movements. Our rigorous process of fundamental analysis and proprietary research, combined with a depth of expertise, allows us to exploit global opportunities over periods of typically five years or more.

We are passionate believers that genuine active management can add value for clients. Our portfolios are very different from the index. The vast majority of our strategies have high active shares.

Inwieweit werden ESG-Ansätze und -Faktoren in den Investmentansätzen integriert?

As bottom up investors ESG considerations are an integral part of our process. The extent to which this information is incorporated into the investment case is based on the materiality of any issue to the long-term sustainability of the company’s business. As a result, the key ESG issues will vary depending on the industry sector, geographic region and core business activities of each company. A list of some of the specific governance and sustainability topics taken into consideration can be provided if required.

Once we have invested in a company on behalf of our clients, our ESG Team continues to assess the quality of management and whether or not shareholder and management interests are aligned.

Worauf liegt Ihr Fokus im Jahr 2025?

Our focus on long-term, growth companies won’t change. We are investing with a view of 5-10 years to capture structural growth opportunities.

However, in 2023 we’ll start offering our private equity strategies in the German and Austrian market. As longterm investors looking for structural change, it is important to get to know companies that do have the potential to disrupt industries early on. Our investment trusts and our closed ended funds are the vehicles we use to participate in private companies before they go public.