Pacific Asset Management

Adresse:

1 Portland Place

UK-London, W1B 1PN

Telefon:

+44 20 3970 3100

Webseite:

Teamgröße:

4 Mitarbeitende (institutional Business, German speaking market)

UK-London, W1B 1PN

Ansprechpartner für das institutionelle Geschäft

Mary MurphyGlobal Head of Institutional Sales, Partner

+44 203 0599 420

mmurphy@pacificam.co.uk

Seb Stewart

Institutional Sales, Partner

+44 203 0599 424

sstewart@pacificam.co.uk

Florence Tilbury

Institutional Sales, Junior Associate Director

+44 203 0599 423

ftilbury@pacificam.co.uk

Unternehmensüberblick/Kurzbeschreibung

Pacific Asset Management (PAM) is a fresh and progressive asset manager, rethinking the conventions of how asset management works for institutional, wholesale, and retail clients around the world. As a privately owned business, unencumbered by legacy, we can rethink the conventions of asset management to create solutions that can adapt to the changing needs of our clients and the investment industry overall.

We have intentionally built PAM around a more innovative, adaptable model to ensure we can continue to deliver value to clients long into the future as the markets and the industry continue to evolve. We continue to push the boundaries of technology, operational infrastructure, and investment research to provide better, more tailored solutions for our partners and clients.

Pacific Asset Management has two core business lines:

- Single Manager Strategies; and

- Adviser Solutions

Our Single Manager Strategies are a collection of hand-picked, "craft" fund management teams managing differentiated strategies which we believe can offer exceptional returns for clients. PAM provides a home for experienced investors who want to focus on managing money whilst benefiting from PAM's global distribution capabilities and its operational, compliance, and tech infrastructure. PAM offers investors the following single-manager strategies, accessible via pooled vehicles and separate accounts:

- Emerging Market Equities

- Global Emerging Markets

- Global Emerging Markets All Cap

- Global Emerging Markets Income - US Equities

- Longevity & Social Change Global Equities

- G10 Macro Rates (Relative Value)

- Global Active Credit

Our Adviser Solutions business provides tech-enabled solutions to investment advisers around the world, including a range of multi-asset funds as part of a model portfolio service (MPS). This is supported by a proprietary client reporting and fund analysis portal called AdviserLab Workstation.

Neue Adresse ab 1.Mai 2024:

74 Wigmore Street,

London, W1U 2SQ

Im deutschsprachigen Markt aktiv seit: 2017

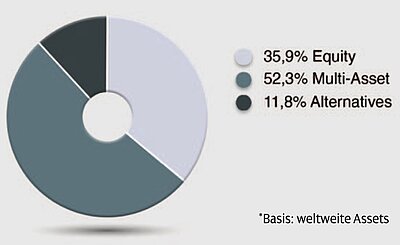

Assets under Management nach Assetklassen*

Assets under Management in Zahlen (in Mio. Euro)

Angebotene Assetklassen

Equity

| Global | Europe | Germany | US | Japan | Asia/Pacific | Emerging Markets | Andere: | |

| Aktiv/Passiv (auch ETFs) | X/X | / | / | / | / | / | X/ | / |

| Quantitativ/Qualitativ | X/X | / | / | / | / | / | / | / |

| Small Cap/Large Cap | X/X | / | / | X/X | / | / | X/X | / |

| Growth/Value | X/X | / | / | X/X | / | / | X/X | / |

| Absolute/Relative Return | X/X | / | / | / | / | / | / | / |

| Factor Investing | X | X | ||||||

| ESG-Ansatz/Impact Investing | X/ | / | / | / | / | / | / | / |

Alternative Investmentlösungen

G10 Macro Rates – Fixed Income Relative Value

Credit – Market Neutral and Long Short

Erläuterung zu den angegebenen Produkten bzw. Strategien

Long-only Emerging Market Equities

- Global Emerging Markets All Cap

- Global Emerging Markets

- EM Income Opportunities

PAM's Emerging Market Equities offerings are managed by the highly experienced North of South Capital Investment Team. The team comprises seven investment professionals with extensive local networks and long-term knowledge of markets and companies across the EM regions. The team has developed a deep understanding of market dynamics and a proven ability to locate compelling value opportunities. The team is led by Matt Linsey and Kamil Dimmich, highly experienced investment professionals who have managed global emerging market equity funds for over 20 years, with a proven track record of generating outperformance through different market environments. The Global Emerging Markets All Cap Strategy was launched on 1st August 2011. From its inception to 31st December 2023, the Strategy has outperformed in 10 of the last 12 full calendar years, outperforming the MSCI Emerging Markets Index by 4.3% on an annualised basis, net of fees. Across all of the EM strategies, the team applies an active, value-based approach combining top-down macro research and bottom-up company analysis to identify mispriced stocks, building a carefully diversified portfolio. The process has been developed over many years, experience of investing in emerging markets. Adherence to the team’s process and their value philosophy is paramount to ensure they can continue to deliver strong outcomes to clients long into the future.

US Equities

The Pacific North American Opportunities Strategy is an actively managed, North American long-only equity strategy that aims to outperform the S&P 500 Total Return index consistently. The Portfolio Manager takes an All-Cap, benchmark agnostic, resulting in a concentrated, high conviction portfolio of approx. 30 eclectic stocks. The Strategy is led by Chris Fidyk, a highly-experienced investment professional who has over 15 years of industry experience in North American equity markets and a proven track record of generating returns across varying market cycles. The team believes that the breadth and depth of the North American equity market provides a fertile ground to find companies which are undervalued by the market, or where current earnings estimates are too conservative, or both. The Portfolio Manager believes that inefficiencies within such a large investment universe are continually created and that these efficiencies can be exploited, particularly for patient investors who seek a portfolio that looks very different from the S&P 500.

Longevity & Social Change Global Equities

The Pacific Longevity and Social Change Strategy is an Article 8, actively managed global long-only equity strategy that invests in companies where revenues are strongly exposed to the Longevity economy or the promotion of longer life and healthy living. The highly experienced investment team is comprised of Lead Portfolio Manager, Dani Saurymper, and Senior Analyst Julia Varesko, who both bring extensive analytical capabilities and a track record in managing diversified strategies. The Strategy's competitive edge comes from marrying an academic network at the cutting edge of demographic and social research with a sophisticated bottom-up investment process. The investment process leverages leading external data providers with sophisticated internal ESG research to create a proprietary verification tool. The team utilise realtime external ESG scoring from TruValue Labs to filter the investable universe, along with Factset Revere which provides revenue-based industry taxonomy helping to identify companies with significant revenue exposure to longevity related industries.

G10 Macro Rates (Relative Value)

The Pacific G10 Macro Rates Strategy is an interest rate and FX macro strategy, implemented in a relative value style, aiming to deliver positive returns with a low correlation to equity and bond markets. The investment team comprises of Co-portfolio Managers Shayne Dunlap, Dr Richard Marshall and Oleg Gustap, all of whom specialise in relative value trading of G10 interest rates and FX. With extensive long-term knowledge of fixed income space, the team has developed a deep understanding of market dynamics and a proven ability to add value.

Focus on implementation efficiency

The team uses common data and focus on implementation efficiency. To truly understand the path of rates and identify market (mis)pricing, the team uses their own proprietary curve model generator. Readily available curve models are often not accurate enough to exploit inefficiencies. The curve model generator allows the investment team to predict on a much more accurate scale the true path of rates.

Global Active Credit

The Pacific Coolabah Global Active Credit Strategy is a liquid investment grade credit strategy aiming to outperform the global corporate bond markets benchmark in excess of 150 basis points by investing primarily in global investment grade corporate debt securities and sovereign bonds, using derivatives where appropriate. The Strategy is managed by leading global active credit specialists, Coolabah Capital Investments (CCI). Coolabah is one of the world’s most active credit managers of liquid, high-grade credit. The investment team combines a highly repeatable proprietary quantitative approach and deep fundamental research with very high trading turnover, taking advantage of mispricings with a view to minimising idiosyncratic default and illiquidity risks. Strong stewardship is central to the investment team’s approach, emphasising a commitment to effect real change, with demonstrable engagement and activism via dialogue with bond issuers.

Worauf liegt Ihr Fokus im Jahr 2024?

In 2024, Pacific Asset Management (PAM) remains at the forefront of championing innovative and specialized ‘craft’ investment management strategies and solutions, which we believe is key to securing exceptional results for our clients. This commitment is underscored by the launch of a Core GEM (Global Emerging Markets) strategy, leveraging the expertise of the same team behind our highly successful Pacific North of South EM All Cap Strategy, showcasing our dedication to innovation and proven investment methodologies.

While PAM has initiated its presence in the DACH region (Germany, Austria, and Switzerland), our focus this year is on intensifying efforts to continue to establish and expand our footprint there, reinforcing our dedication to deepening client engagement and enhancing our services in these markets.